After wild swings before and after the economic downturn, home prices are inching closer to their pre-recession peaks in the Sarasota-Manatee County region.

After wild swings before and after the economic downturn, home prices are inching closer to their pre-recession peaks in the Sarasota-Manatee County region.

Single-family homes and condominiums sold for a median $260,000 in the two-county area during the second quarter of 2019, a 4% increase over the year, according to a new report from real estate researcher ATTOM Data Solutions.

That price is just 3% off the pre-recession median high of $267,500 set in late 2005, just before the housing bubble burst. The Sarasota-Manatee area is one of 31 metro areas among the 108 largest in the U.S. where home prices still fall short of their pre-bust pinnacles.

That’s no surprise, given how deeply local home prices plunged during the downturn. The median price hit bottom at $127,000 in early 2011, a 53% dive from the peak, ATTOM’s report shows.

After the recession, local prices rebounded to double-digit annual gains, but those have slowed in recent years.

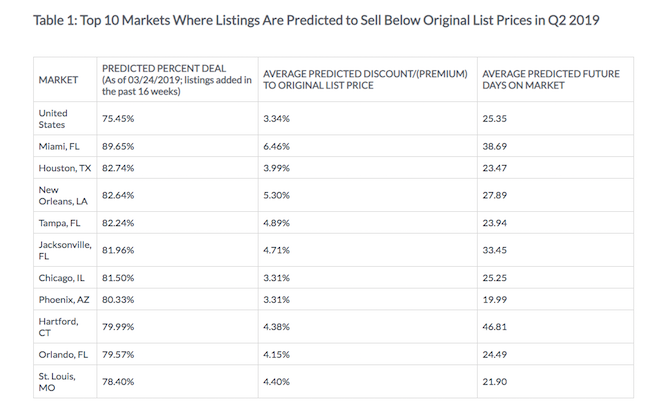

“In the general housing market, all indices have been pointing to modest appreciation in accordance with historical norms of 3% to 5%, but not the accelerated rates we have experienced since 2012,” said Robert Goldman, an agent with Michael Saunders & Co. in Venice. “If sellers failed to recognize this shift, then a tug of war of sorts would arise, wherein it would take longer, on average, to sell a home, the spread between final sold price and original list price would widen, and inventory would increase with the potential for stagnant pricing. There appears to be a growing body of evidence for this.”

Asking and selling prices are in a state of flux here, he said. Single-family homes are selling at 89% of original list price and condos at 90%, less than the customary 92% to 93%. Residential sales that used to take 60 to 75 days to close now need 90 days.

“All in all, barring unforeseen events, we should settle into a neutral market, with modest and sustainable appreciation, provided sellers have realistic expectations, in alignment with where the market is, rather than where one wishes it to be,” Goldman said.

Sarasota-Manatee homeowners are holding on to their properties longer, an average of 8.25 years before selling. That compares with two to three years during the frenzied buying-and-selling before the housing crash.

Those homeowners who sold in the second quarter realize an average price gain of $63,198, or 32.1% from their original purchase price. That was 5% higher over the year.

Nationwide, home and condo sales rose nearly 11% over the quarter and 6.4% annually to a median $266,000 — a new price peak. Homeownership also hit a new high at an average 8.09 years.

“As warmer weather brings a rush of house hunters to the market, the latest spike in median home prices marked the largest quarterly increase since the second quarter of 2015 and the third-biggest increase since the market started climbing out of the Great Recession in 2012,” said Todd Teta, chief product officer at ATTOM.

In Sarasota-Manatee, cash buyers are still major players. They accounted for nearly 43% of all home and condo sales during the April-June period, the eighth-highest ratio among the U.S. metros studied. Nationwide, cash sales were down to a 25% share.

Sarasota Herald Tribune July 18, 2019

Sarasota

Sarasota

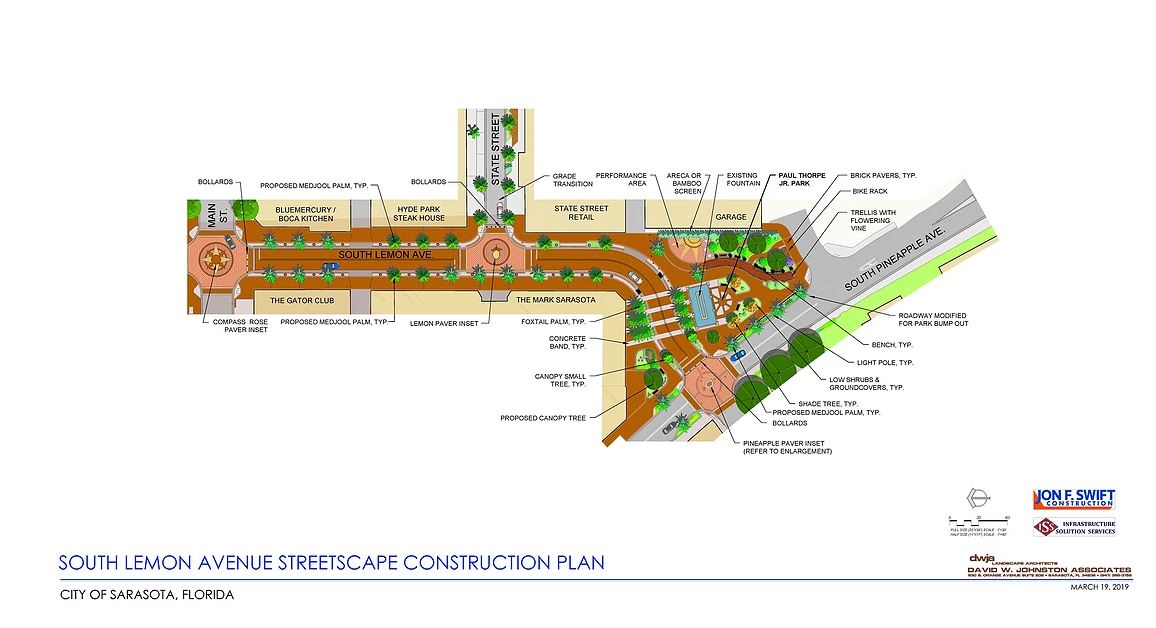

The project will include the segment of Lemon Avenue between Main Street and Pineapple Avenue. Plans call for the installation of bricked streets and curbless sidewalks, mirroring the look of the Lemon Avenue mall to the north. City officials have called the project an opportunity to improve the pedestrian experience along the street.

The project will include the segment of Lemon Avenue between Main Street and Pineapple Avenue. Plans call for the installation of bricked streets and curbless sidewalks, mirroring the look of the Lemon Avenue mall to the north. City officials have called the project an opportunity to improve the pedestrian experience along the street. Consumer confidence in Florida reached its highest level in 17 years, increasing 1.4 points in April of 2019 to 102 from a revised figure of 100.6 in March.

Consumer confidence in Florida reached its highest level in 17 years, increasing 1.4 points in April of 2019 to 102 from a revised figure of 100.6 in March.

Bay Park Conservancy plans to build out the bayfront project over the next 15 to 20 years.

Bay Park Conservancy plans to build out the bayfront project over the next 15 to 20 years. In a reverse of headlines – Regional Home Prices Lag. Home prices continue to rise in Southwest Florida, but not as fast as in the state or nationally.

In a reverse of headlines – Regional Home Prices Lag. Home prices continue to rise in Southwest Florida, but not as fast as in the state or nationally.